How Does Crypto OTC Affect the Market?

Crypto OTC Affect the Market

OTC deals involve cryptocurrency trading between two parties without the need for an exchange. Transactions are settled in stablecoins. The rates of discount are influenced by influxes of buyers. This can result in future price fluctuations. Typically, large amounts of cryptocurrency are traded over the counter via escrow agents or brokers. The transactions are not public and do not affect the market directly. Instead, the cryptocurrency is sourced from large holders and miners.

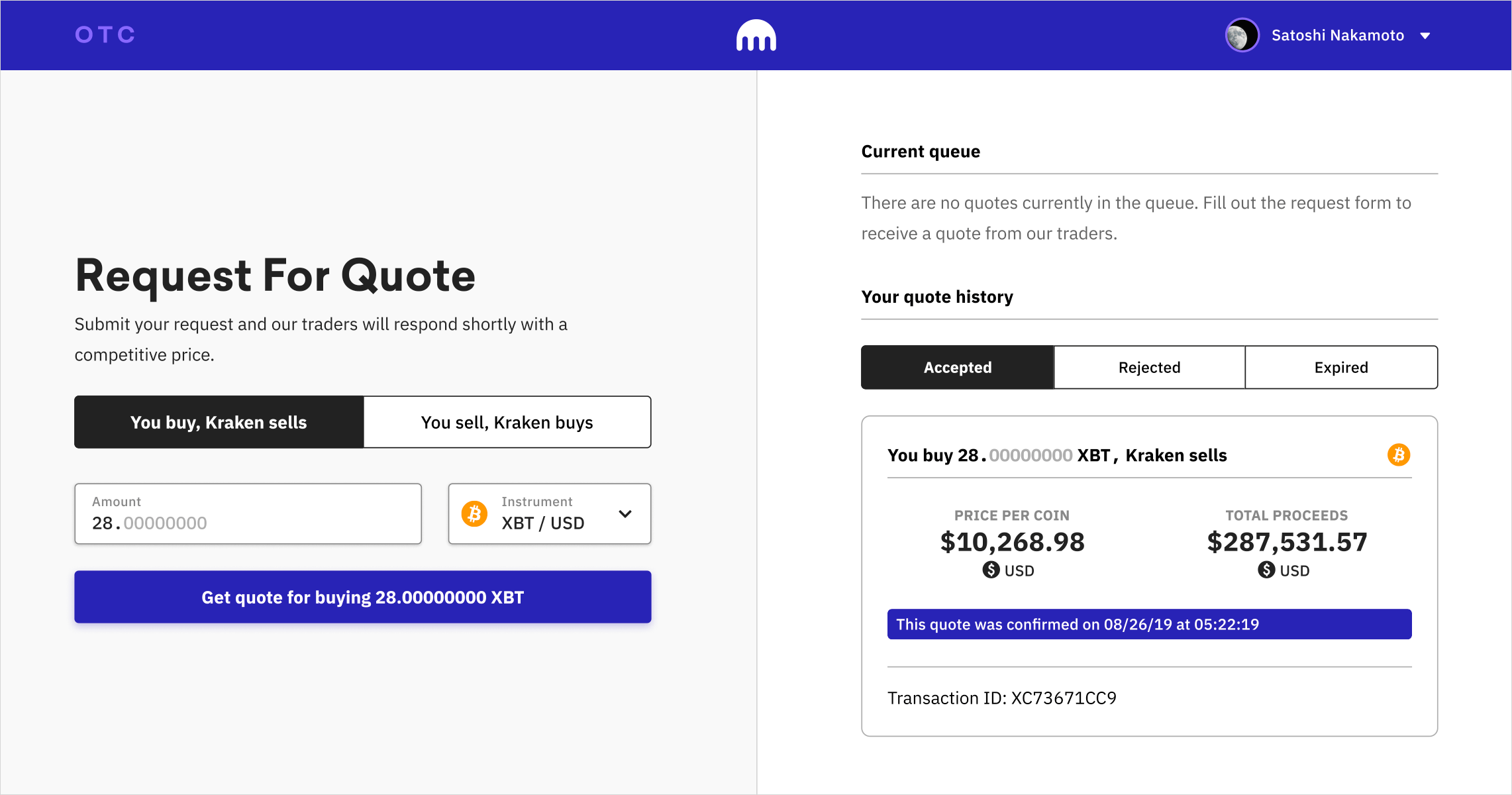

The OTC market is a good indicator of market sentiment. For example, if a high-net-worth individual purchases Bitcoin at the same price as the previous day, it means the individual is confident in the currency. Likewise, if a seller posts sell-orders, it may mean that the market is about to move to the downside. Despite the risks, trading in cryptocurrency over the counter is easy. Most trading sites offer chat applications for customers to interact with an OTC desk and request a quote.

When it comes to OTC, you should be aware of the risks involved. As mentioned, the market is not transparent, so it’s important to be cautious. You can never be too careful, because you don’t want to get swindled. However, you should know that the OTC market is important for the overall crypto ecosystem. So, how does cryptocurrency OTC affect the market? para: Despite its small size, the OTC market has a major impact on the cryptocurrency ecosystem. Its presence in the crypto ecosystem is an essential part of the ecosystem. The CEOs of some of the most popular crypto exchanges, such as Binance, receive ample media coverage, but the OTC market is often overlooked by the general user base.

How Does Crypto OTC Affect the Market?

In the case of ICOs, OTC desks are an integral part of the crypto ecosystem. They allow the users to trade cryptocurrencies between various entities without a central exchange. The benefits of trading on these platforms are numerous, but they also have limitations. The OTC market is more volatile than the exchanges and can result in higher costs. Moreover, it is prone to price changes.

OTC is crucial to the crypto ecosystem. It allows the user to trade digital currencies without an exchange. OTC can also result in massive losses, as well as significant volatility. The liquidity of OTC is vital. When you buy and sell cryptocurrencies, the OTC is important. For example, if you want to buy Bitcoin, you need to deposit funds and coins into a wallet. Once you have deposited them, you can start trading in any currency they choose.

The OTC market is similar to a stock exchange in the real world. Traders can buy or sell any amount of cryptocurrency. They will contact sellers and ask for the address of the deposit. Then, they will send payment instructions, which are typically very simple. When you sell or buy a certain cryptocurrency, the OTC can increase or decrease the value of your digital assets. The OTC market is often an ideal way to trade cryptocurrencies.