Why Are Tech Valuations So High?

Tech Valuations

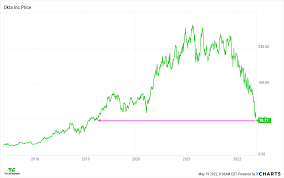

For over a decade, stable economic growth and low interest rates created a fertile environment for many growth stocks, including technology companies. This helped to drive many Tech Valuations higher than would normally be the case, with some reaching astronomical multiples of earnings. While the market decline of 2022 brought some of these high valuations back down, the rapid pace of technological innovation means that many companies operating in this sector remain highly valued.

A number of factors are at play in determining the valuation of a tech company, with the key factor being the business model. For example, a firm’s unique selling point (USP) should help to give it a competitive edge, and a solid plan for how that USP can be monetised should be a central consideration in any valuation process. This can include everything from whether the firm sells software or hardware, to how it intends to distribute and monetize its products.

Another element to consider when valuing a tech company is its current market penetration. This can be especially important in cases where the market is still undergoing a transition, and if the firm has managed to secure a sizeable share of this new market, it may be able to justify an inflated valuation. The other aspect to consider is how the firm expects its market penetration to evolve over time. This can be particularly tricky to calculate for technology companies, which are often unable to project their earnings beyond the next few years due to the nature of the business.

Why Are Tech Valuations So High?

Lastly, the valuation of a tech company can also be affected by its financial situation and external markets. For example, higher interest rates typically make it more expensive to borrow money, which could potentially lower the value of technology stocks by increasing the discount rate used to calculate future expected earnings.

In today’s fast-paced digital era, the valuation of technology companies has become a focal point for investors, analysts, and industry stakeholders alike. Tech valuation refers to the process of determining the financial worth of a technology-based company, considering its assets, revenue streams, growth potential, market dynamics, and competitive landscape. This intricate evaluation is crucial for investors seeking to allocate capital wisely in a sector known for its rapid evolution, disruptive innovations, and high volatility.

Valuing a technology company requires a careful and thorough approach, which is why it’s often best to use an experienced advisor when making such an assessment. They will be able to provide invaluable insight and support in determining the true worth of a tech firm, and can help to ensure that the process is completed fairly and efficiently. In a time when COVID-19 and other crises have sent a number of investors running for the hills, it’s vital to have someone on hand to provide guidance and assistance. Contact a professional advisor today for more information. Tech Valuations: Why Are They So High?